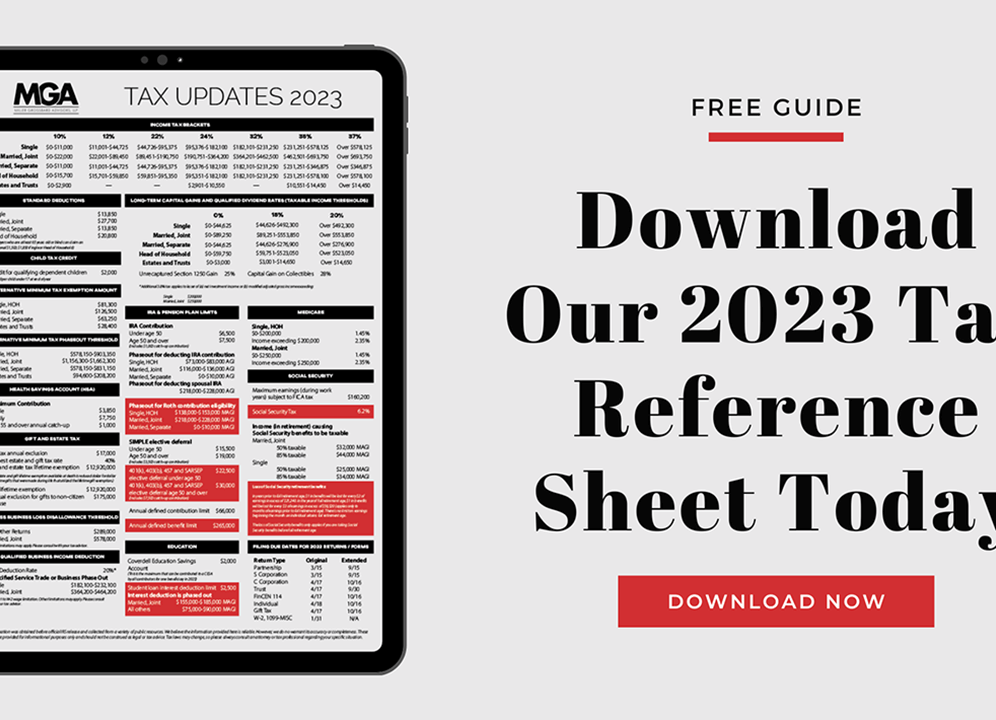

Do you feel your current CPA is only giving you a rearview mirror perspective, without any guidance on what's up ahead? At MGA, we think taxes shouldn't hold any surprises. That's why we don't see a tax return as a one-off event, but rather an annual milestone in an ongoing journey of effective tax strategy.

We work side-by-side with you throughout the year, conducting year-end analyses and strategic sessions to uncover opportunities that could positively affect your tax outcome. By doing so, we ensure that come April, you're well-prepared and not caught off-guard. With MGA, you'll have the benefit of knowing in December what you'll owe in April.

While tax-saving strategies are important, they need to be weighed against their overall impact on your wealth. If a tactic saves you 75 cents in tax but costs a dollar to implement, we'll tell you outright that it's not a sensible decision. Our advice always aligns with your broader financial goals.

Who Can Benefit from Our Services?

- Business Clients. Our typical client generally has between $5 and $100 million in gross revenue each year. The client that we can assist and provide the most value to is a company that has this level of income and has the ability to make decisions that can impact their tax situation. A company that is growing and needs strategy and assistance in getting to the next level. We also work with clients in setting up the appropriate tax structure for their next business venture.

- Individuals. We work with high net worth clients who have a personal tax return that includes more than a W-2 and some itemized deductions. Most individual returns don’t provide many opportunities for tax planning strategies outside of charitable planning. However, the client we generally work with is one that has numerous partnerships and other investments, a need for assistance in long-term estate planning with respect to taxes, and the owner of the businesses that we provide tax work for.

While Congress and the IRS make everything complex, you can rest assured that we are keeping up with the ever-changing tax laws. Our team ensures you're making well-informed and smart decisions for both your personal and business finances.

Why wait until tax season to start planning? With MGA, you get expertise and experience that can adapt quickly to the ever-changing tax landscape. Let’s get started on maximizing your tax efficiency today. We're ready when you are.

- Federal and state tax preparation and compliance for individuals, businesses, estates, and trusts

- Foreign reporting

- International planning techniques

- IRS and state tax audit consultation and appeal representation

- Retirement plan options

- Tax planning strategies

- Transaction analysis

- Your problem to solve